Entrust can guide you in purchasing alternative investments with your retirement cash, and administer the obtaining and advertising of assets that are typically unavailable by way of financial institutions and brokerage firms.

Restricted Liquidity: Lots of the alternative assets that can be held in an SDIRA, which include property, private equity, or precious metals, is probably not effortlessly liquidated. This can be a problem if you should accessibility funds swiftly.

SDIRAs are frequently used by fingers-on traders who are ready to tackle the dangers and responsibilities of choosing and vetting their investments. Self directed IRA accounts can also be perfect for traders who may have specialized information in a niche sector that they would want to invest in.

When you’ve found an SDIRA company and opened your account, you may be thinking how to actually start out investing. Comprehension each the rules that govern SDIRAs, and also how to fund your account, will help to lay the inspiration for just a way forward for successful investing.

Making quite possibly the most of tax-advantaged accounts lets you retain additional of the money that you simply invest and get paid. Determined by no matter if you select a traditional self-directed IRA or a self-directed Roth IRA, you may have the prospective for tax-no cost or tax-deferred progress, provided specific disorders are met.

Transferring resources from a single style of account to a different style of account, which include shifting cash from a 401(k) to a standard IRA.

Be answerable for the way you increase your retirement portfolio by using your specialized knowledge and pursuits to take a position in assets that suit together with your values. Got expertise in property or non-public equity? Utilize it to help your retirement planning.

Number of Investment Selections: Make sure the service provider enables the types of alternative investments you’re enthusiastic about, for instance real estate property, precious metals, or personal equity.

And because some SDIRAs such as self-directed standard IRAs are issue to required least distributions (RMDs), you’ll need to approach forward to make certain that you've enough liquidity to fulfill the rules established from the IRS.

Set only, for those who’re hunting for a tax efficient additional reading way to develop a portfolio that’s more customized towards your interests and skills, an SDIRA can be the answer.

Regardless of whether you’re a monetary advisor, investment issuer, or other fiscal Experienced, discover how SDIRAs read could become a robust asset to grow your company and realize your Skilled plans.

As an Trader, nonetheless, your options will not be limited to shares and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can transform your portfolio.

Homework: It can be termed "self-directed" for just a cause. With the SDIRA, you happen to be entirely responsible for carefully researching and vetting investments.

This features knowing IRS polices, handling investments, and preventing prohibited transactions that might disqualify your IRA. An absence of information could bring about pricey blunders.

Should you’re searching for a ‘established and forget about’ investing approach, an SDIRA possibly isn’t the correct choice. Simply because you are in complete Handle in excess of every investment manufactured, It really is your choice to perform your individual due diligence. Try to remember, SDIRA custodians will not be fiduciaries and can't make recommendations about investments.

No, You can not put money into your own organization using a self-directed IRA. The IRS prohibits any transactions concerning your IRA and your possess business enterprise since you, as being the owner, are regarded as a disqualified man or woman.

Bigger Service fees: SDIRAs often come with greater administrative expenses when compared with other IRAs, as particular areas of the executive approach cannot be automated.

A self-directed IRA is really an incredibly strong investment vehicle, but it surely’s not for everybody. As the stating goes: with fantastic power will come terrific responsibility; and having an from this source SDIRA, that couldn’t be more true. Continue reading to know why an SDIRA may, or won't, be for you.

Occasionally, the expenses connected with SDIRAs is often larger plus more difficult than with an everyday IRA. This is due to from the enhanced complexity affiliated with administering the account.

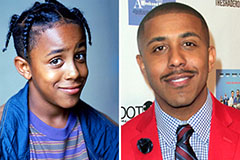

Marques Houston Then & Now!

Marques Houston Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!